What is reverse charge mechanism in GST with example?

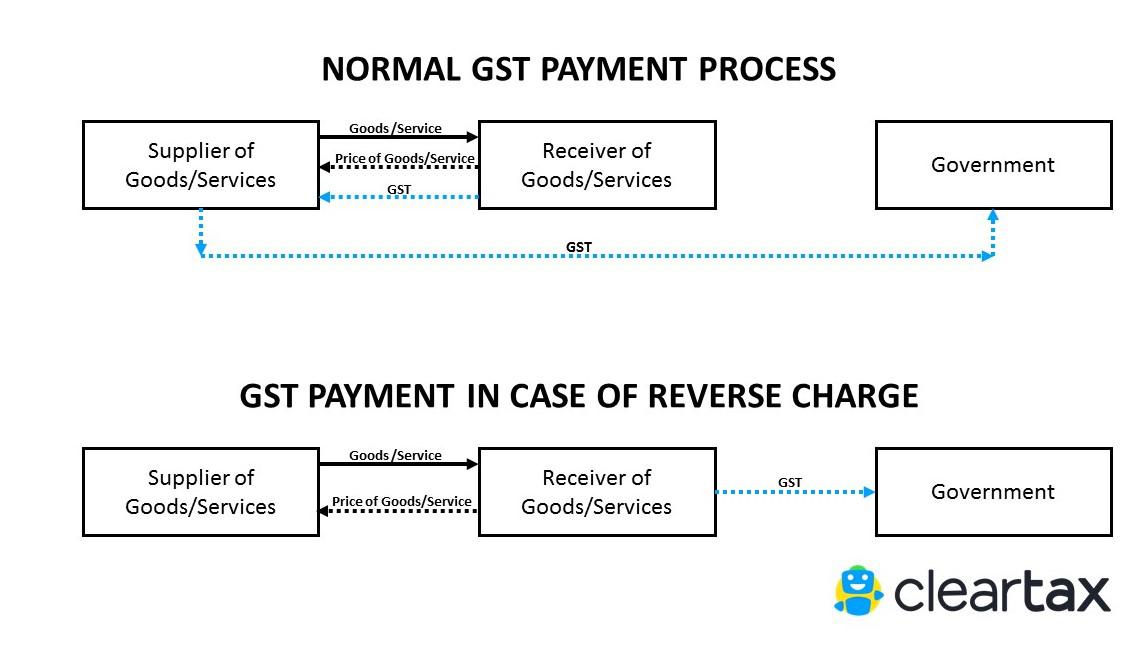

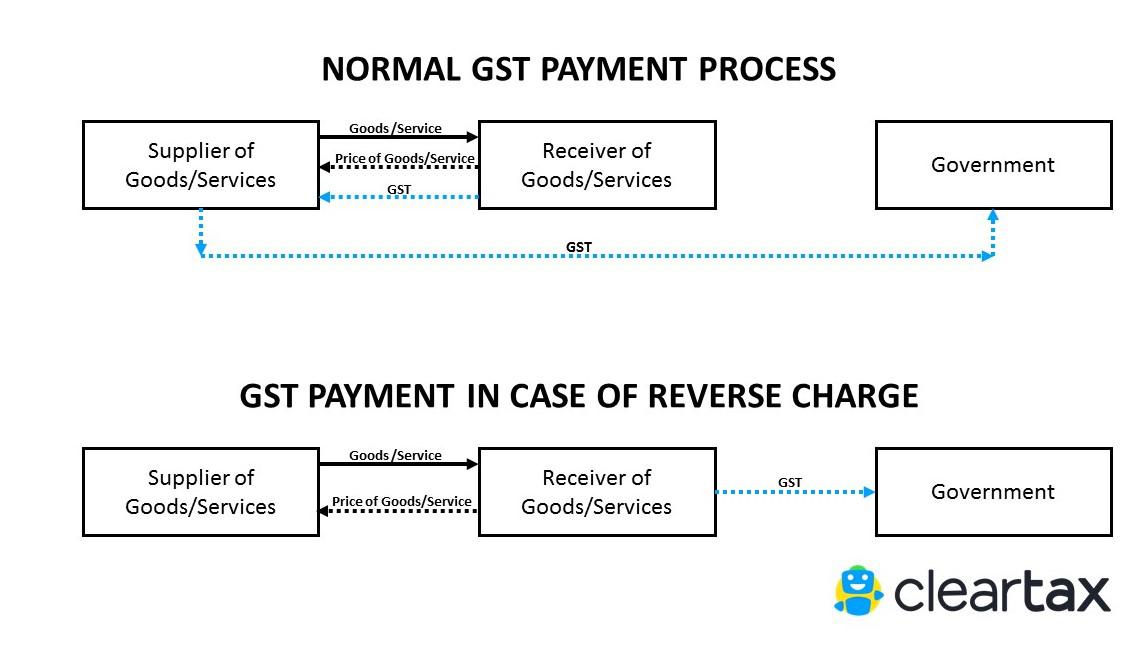

Reverse charge is a mechanism where the recipient of the goods and/or services is liable to pay GST instead of the supplier

Reverse charge is a mechanism where the recipient of the goods and/or services is liable to pay GST instead of the supplier

1. What is Reverse Charge?

Normally, the supplier of goods or services pays the tax on supply. In the case of Reverse Charge, the receiver becomes liable to pay the tax, i.e., the chargeability gets reversed.

No comments:

Post a Comment